Global Bitumen Market Weekly Reports

Political Tensions VS Bitumen Price Variations in September

Russia, Ukraine, North Korea, and Gabon have been involved in various conflicts. Over the past week, Russia and Ukraine escalated their drone and missile attacks against each other, while North Korea fired two missiles simulating an atomic attack on South Korea. In Gabon, coup plotters appointed a new leader, and there’s uncertainty about how these political tensions might impact the global economy. Meanwhile, reports from eight reliable sources indicate that politicians at the European Central Bank are quite concerned about weakening economic growth prospects. Although discussions are ongoing, efforts to prevent an increase in interest rates persist. In August, Germany’s employment situation was worse than expected, dropping for the fourth consecutive month, raising concerns about a potential second economic recession within a year. ExxonMobil predicts that the world will continue to rely on oil and gas for over half of its energy needs until 2050. India, the third-largest importer of crude oil globally, announced its intent to purchase from the lowest-priced exporters. In the past week, significant withdrawals from American oil reserves, coupled with the negative impact of a Gulf of Mexico storm, led to rising oil prices. Additionally, the value of the US dollar decreased due to reduced predictions of interest rate hikes after unfavorable job data. Bitumen Prices in the Global Market Bitumen prices in various regions fluctuated. Singapore’s HSFO CST180 remained at $535, Singapore and South Korea traded bulk bitumen at $470 and $425, respectively. Bahrain’s bitumen price stayed at $440, while European bitumen prices ranged from $500 to $580. In India, bitumen prices increased by approximately $14 on September 1, marking an overall rise of $63 in the past 40 days. In Iran, prices remained relatively stable, with a 37% reduction in competition due to pressure from customers to lower prices and issues like container shortages affecting exports. Despite being lower than global competitors, Iran bitumen prices face pressure from buyers, particularly from India, to decrease further. However, the direction of prices is expected to become clearer with the influence of new internal factors.

Empowerment of Price Increasing Factors

During the last week, drone and missile attacks of Russia and Ukraine were escalated against each other. In the meantime, North Korea simulated the atomic attack to South Korea by firing 2 missiles. In Africa, the coup plotters of Gabon appointed a new leader for their country. Yet, it is not clear how these political tensions might affect the world economic situation. At the same time, based on the reports of 8 informed sources, Reuters mentioned that politicians of European Central Bank are considerably worried about the weakening of economic growth perspective. However, although negotiations about this matter go on, the movements to stop the increase of interest rate continue too. Based on the reports, in August, the employment situation in Germany was worse than what was expected, and it dropped again for the fourth consecutive month. This has caused concerns about the second economic recession within the last year. In the meantime, in the latest prediction of the American company of ExxonMobil, it was announced that the world will supply more than half of its energy needs from oil and gas till 2050, and at the same time, on Wednesday, Hardeep Singh Puri, the minister of petroleum and natural gas of India told ET Now TV channel: India will purchase crude oil from any exporters who supply it with the lowest price. India is the third biggest importer and consumer of crude oil in the world with an import rate of over 80%. During the past week, according to Reuters, the release of industrial data about significant withdrawals from American oil reserves, as the world’s largest fuel consumer, also, the negative impact of the Gulf of Mexico storm on investors caused oil prices to rise this week. Another factor contributing to the increase in oil prices can be attributed to the decline in the value of the US dollar due to a contraction in predictions regarding the increase in bank interest rates after the release of data related to unfavorable job conditions in that country. After continuous fluctuations, Singapore’s HSFO CST180 remained at the level of 535 USD in the last week. Bulk bitumen prices of Singapore and South Korea were traded at 470 and 425 USD, respectively. Bahrain bitumen price is still fixed at the level 440 USD, and in Europe, bitumen price subsided in the range of 500-580 USD. Bitumen price in India increased around 14 USD for 1 September, and an overall increase of 63 USD was observed within the last 40 days. In Iran, prices were almost stable with a reduction in the level of competition at 37% as a result of customer pressures to reduce the prices. The factors like shortage of containers have affected the export process too. Although Iran bitumen prices are lower than the global competitors, the pressures from buyers’ side, especially Indian ones, have raised to reduce the prices. However, it is expected to find a clearer direction of the prices with respect to some new internal components. You can contact the experts of Black Gold to get competitive prices with highly qualified services.

Uncertainty Suppressing Bullish Sentiment

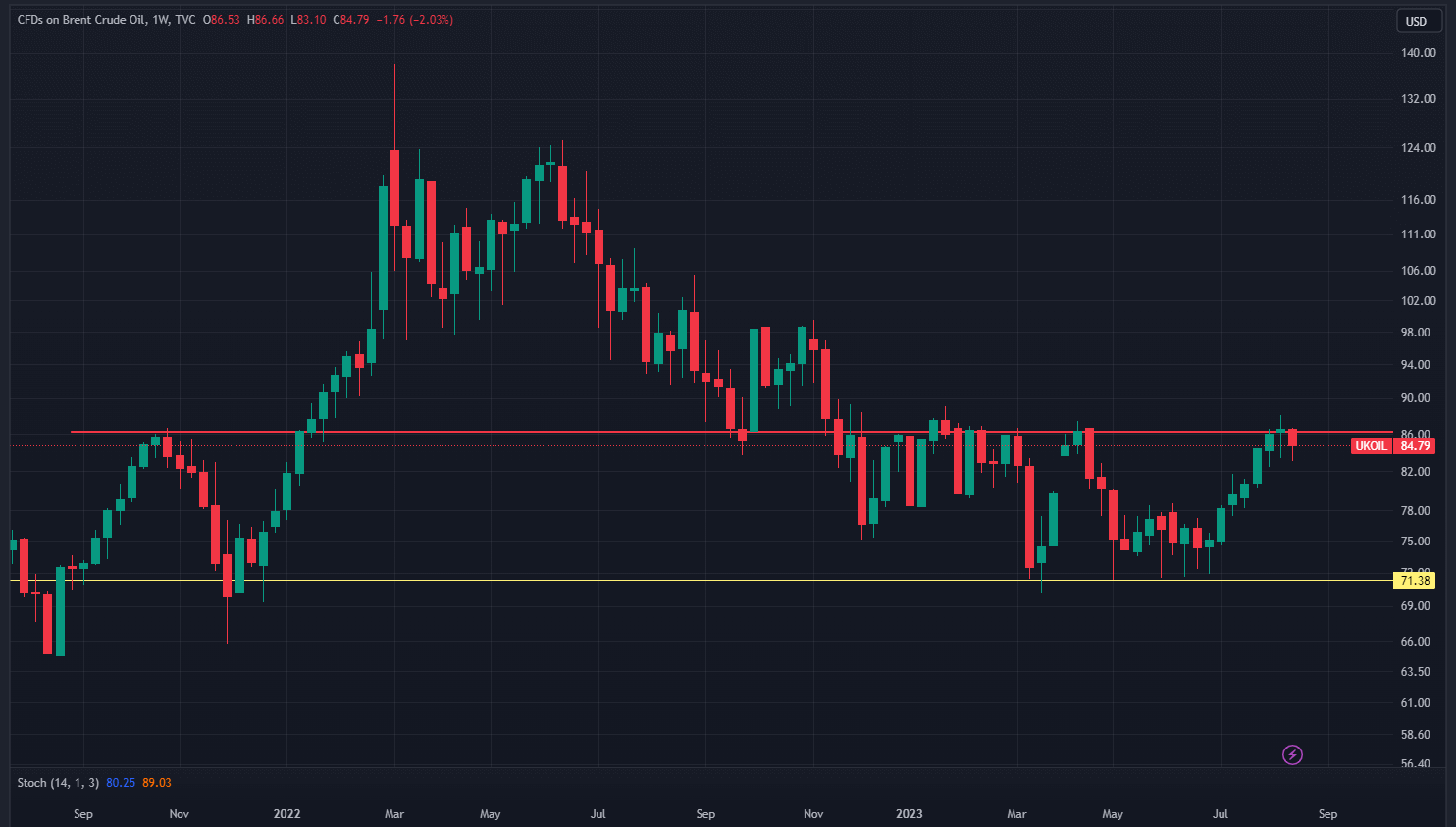

On August 18, Brent oil closed at $84.79 and WTI settled around $81.36. Check out the technical analysis. Selling power took over and oil price came down by about 2% during the week. It was not a surprise to see oil losing gains as we mentioned in the last episode. The price is stalling in the 23% monthly fib level and it is not close to breaking the area either. The overall weekly movement is probably downward again. The week mostly didn’t bear any specific or new happening to affect commodities. Hot topics, again, were economic concerns. Expectations for the coming raise of US interest rates are weighing down on crude prices. It is also affecting the outlook for demand. Market participants are afraid to see lesser demand from China. Reports on supply are also interesting. Tanker Tankers stated that Iran has surpassed Saudi Arabia in crude oil exports to China. This is while Saudi and China agreed on expanding their crude trades. Fuel and bitumen directions are not clear either. Although Singapore fuel increased on Friday, 18 Aug after a week of falling, there aren’t enough data to guess the future. Bitumen markets also gradually fell back in Europe with uncertainty rising in Asia. India raised bitumen prices by 24.5 USD on August 15, making the country’s total price increase of 50 USD in one month. There are also some reports on the possibility of a 4% increase in the next 3 days in Iran’s vacuum bottom. If you need bitumen, contact us for the exact price.

Market Anticipating Oil Price Direction

BRICS leaders have reached an agreement to expand the BRICS group by welcoming Iran, Saudi Arabia, the United Arab Emirates, and three other countries. This marks the first expansion of BRICS since South Africa joined in 2010. Narendra Modi, the Prime Minister of India, stated, “I believe that with the entry of these countries, we will infuse more energy into the organization.” Analysts believe that the expansion of BRICS will strengthen the countries known as the Eastern Bloc and further enhance China’s and Russia’s influence in Africa, consequently reducing the dominance of the dollar in global transactions. By deepening the real estate crisis in China, one of the largest real estate companies, “Evergrand,” based in China, has declared bankruptcy in the United States. This move comes at a time when troubles in the Chinese real estate market have added to concerns about China’s economic situation. China’s economic growth has slowed, its exports have declined, and youth unemployment has hit a record high. Meanwhile, China has reduced short-term loan interest rates to tackle the economic crisis. In a recent move, the Chinese government left long-term interest rates untouched but lowered the base rate for one-year loans from 3.55% to 3.45%. As worries intensify about China’s economic situation, oil prices experienced a slight decrease throughout the week. However, global markets appear to be awaiting interest rate determinations. The officials of the US Federal Reserve of the United States, policymakers of the European Central Bank, central banks of the UK, and Japan are set to negotiate at the annual Jackson Hole meeting in 2023. The decisions made in this meeting might impact global financial and energy markets. During the first three days of the week, the price of HSFO 180 CST in Singapore exhibited significant positive and negative fluctuations, ultimately settling around $550 by Wednesday. Singapore bitumen price also remained unchanged at approximately $460. South Korea bitumen price experienced a $5 decrease, settling at $415. The price of Bahrain bitumen remained unchanged at $440, while European bitumen prices slightly decreased, ranging from $520 to $580. In India, after a mid-August increase, the price of bitumen managed to recover $50 throughout August, and there is speculation of another increase in early September. In Iran, on August 23rd, the base price of vacuum bottom bitumen increased 4.5% to bring about a clearer market direction. Despite customer pressure for price reduction, it seems that if the trend in oil prices becomes more defined, prices may continue their upward trajectory due to the end of maintenance and the start of the bitumen export season.

Headwinds Coming Towards Crude

On August 25, Brent oil closed at $84.07 and WTI settled around $79.97. Watch crude technical analysis and comment your ideas: Brent gained about 2% on Friday following Powell’s Speech after a couple of bearish days. Fed Chair Powell held a hawkish tone at the Jackson Hole Symposium. “The lower monthly reading for core inflation in June and July were welcome, but two months of good data are only the beginning of what it will take to build the confidence that inflation is moving down sustainably,” he said. Inflation is still above where policymakers feel comfortable, however, the Central bank leader didn’t give any indication about the Fed’s next move. In addition to the US, the economic condition in China is also unclear. The real estate is facing a crisis and it caused Evergrande Group, a property giant in China, to file for bankruptcy protection in the US. New appearing agreements are also causing uncertainties about the Middle East. Last week, the BRICs invited Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE to join the grouping of top emerging economies in January 2024. Some talk about a new currency among the BRICs countries to remove dollar from their international trade. There is also more possibility of increasing supply from Iran, Venezuela, and Kurdistan. Fuel and bitumen were unstable again last week. On one side, Iran increased vacuum bottom rates. On the other hand, fuel and bitumen prices relatively decreased. Although we are in bitumen season, market players are still hesitant to make their purchases. If nothing unprecedented happens, India may increase the price on September 1st too.